AMS donates over 150 books to Louisiana Schools

This year, the American Meteorological Society’s Annual Meeting was held in New Orleans, Louisiana, and drew in over seven thousand registered attendees. It was thanks to the generosity of these attendees that the AMS was able to donate over 150 books to local Louisiana schools as well as member donations through the AMS Public Outreach Funds.

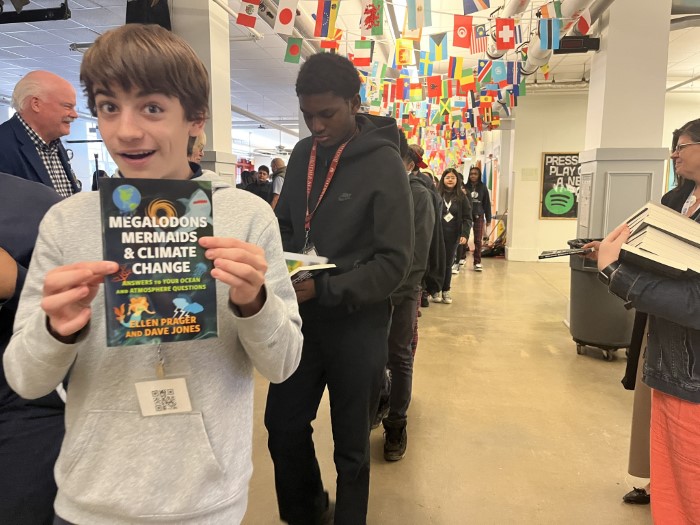

On Tuesday, 14 January, authors Ellen Prager and Dave Jones delivered their book, titled “Mermaids, Megalodons, and Climate Change,” to 82 eighth grade students at one of the receiving schools, The International School of Louisiana. They gave a lively and engaging presentation about oceanography and meteorology, where they answered common questions kids ask them in their respective fields as well as any specific questions that were geared towards New Orleans. At the end of their talk, Ellen and Dave handed out signed copies of the chapter book to each student where all cheered.

“It’s just so rewarding just to see how engaged they are,” Prager said after the talk. Some students continued to ask the authors questions even as they headed back to class, while others immediately opened their books and exclaimed how excited they were to start reading it once they got home.

The school talk and fundraiser program was an effort led by the Local Organizing Committee (LOC) that was co-chaired by Barry Keim and Rebecca Morss along with LOC member Lauren Nash (Warning Coordination Meteorologist (WCM), NWS New Orleans/Baton Rouge). Lauren said that the idea came from her work with the National Weather Service and their connections to Louisiana schools.

“Anybody that purchased a book with their registration, [that book] is going to come to our local office, and then we'll distribute them at our school talks and to any teachers that come to our STEM events, because we do 20 to 50 of those a year. It worked out really nicely,” Nash said. She also highlighted that the NWS tries “to find schools in areas that are public, schools that are more underserved, and minority serving schools” when they’re reaching out to do talks and outreach programs.

After the talk and book presentation, Nash expressed gratitude for the AMS and this fundraiser, especially due to its crucial timing. “Louisiana is at the center of the climate crisis in the country. We're losing land faster than anywhere else in the world, almost. With sea level rise, with our hurricanes, we have tornadoes, we have fires, we have drought. So anytime that we can get books like this that can educate our youth, then we're gonna do much better in the future with keeping people safe.”

Thank you to everyone who donated!